Not very long ago, it was rare to find someone in finance who knew what an Application Programming Interface (API) was. Open Banking, the new paradigm shaping the financial industry worldwide, is changing that.

While Open Banking originated as a regulatory mandate, FIs have found an opportunity to tap into new business models, leading to market-driven initiatives. As a matter of fact, Open Banking is growing rapidly in the US, despite the lack of a regulator-led standard.

Today, many financial institutions around the world have already implemented their own APIs. Their systems are ready to interface with partners in ways that provide customers with extra value and the institution itself with new ways to grow. APIs aren’t just some systems integration detail — they are products that empower developers to delight end users.

Devising an API monetization strategy to realize a larger ROI (return on investment) is a big must in today’s market. COVID-19 has provided a burning platform for change, now.

This API economy opens new horizons for all types of institutions, by enabling collaboration and the co-creation of new solutions leveraging what others have available, in a robust, interconnected and integrated roadmap.

How Open Banking boosts innovation?

Financial Institutions are looking for:

- An easy way of find the B2B FinTech solutions they need when they need them

- A way to normalize the related FinTech APIs in a compliant manner

- The integration of these FInTech solutions into their core systems

- Simple contracting process for numerous solutions from various FinTechs

Financial Institutions are able to safely innovate by experimenting with ideas, building solutions, trying for safety and relevance, and ramping up their digital transformation journey, that encompasses:

- Promotion of innovation with external parties,

- Growth of an ecosystem of partners and customers where collaboration and crowdsourcing are encouraged,

- Translation of digital assets into digital experiences.

How Open Banking boosts API monetization?

Financial Institutions can expand to new business models through the monetization of APIs. This can be done by turning API consumers (developers) into customers and APIs into products, encompassing:

- Manage API as products, granting grant access to developers interested in APIs for building new products,

- Turn third parties into collaborators who add business value,

- Monetize bank infrastructure, by providing Corporates licensing, compliance and regulatory infrastructure, and other functionalities.

What are the benefits of embracing Open Banking?

By monetizing APIs, organizations can turn a sunk-cost investment into a new revenue stream, turning cost centers departments (e.g tech support or internal developer teams) into revenue generators, thus revamping their balance sheet by transforming costs into assets to be monetized.

By integrating across value chains — including owned and third-party touchpoints — and by enabling a much faster-pace of customer interaction, APIs allow institutions to gather data on how customers prefer to interact and what products and services they like on the fullest possible range of channels and devices.

FinConecta is a driving force in the Open Banking space: Introducing Open Banking as a Service

Based on the concept of Software as a Service (SaaS), Open Banking as a Service (OBaaS) is the ultimate strategy to actively step into the benefits of Open Banking without costly investment in IT stack and complex and long technology implementations. FinConecta offers its unique Open Banking as a Service (OBaaS) as a value proposition that delivers Open Banking capabilities with just one connection. This turnkey solution allows FIs to embrace digital transformation in a self-paced, secure, and scalable manner. FIs can experiment with ideas, build and validate solutions, and ramp up innovation in a single environment. FIs are able then to expand into new business models by creating new revenue streams through the monetization of APIs, achieving an accelerated time to market.

What does Open Banking as a Service (OBaaS) enable?

FinConecta’s model allows FIs to pick their starting point, and grow following their own roadmap with a modular framework, at a remarkable time-to-market and a fraction of the cost.

FIs can achieve continuous innovation and connect with developers and other parties through a comprehensive, customized Developer Portal, that offers built-in app registration and support for automatic and manual API key approval.

What is the next step to start or deepen your institution’s Open Banking journey?

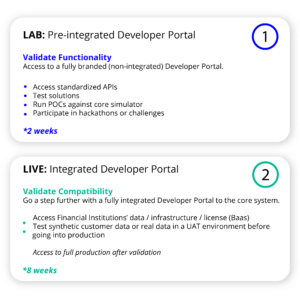

If your institution wants to crowdsource solutions to existing pain points without technology integration:

Open Banking Lab is the right option: it provides FIs with their own pre-integrated branded platform that allows testing new solutions, run proof of concepts, validate third-party capabilities, manage a portfolio of digital solutions, execute innovation programs; all in one single place.

It enables FIs to provide a crowdsourcing space to 3rd parties, pre-integration to production -ideal for experimentation, hackathons, etc.

Leveraging a normalized API catalog, developers can access, build and share new solutions. It facilitates engagement and visibility to all key stakeholders.

OB Lab is populated with simulated data so that FIs don’t have to expose sensitive information while testing.

If your institution is ready to integrate 3rd party solutions to the core banking system:

Jump into Open Banking Live! It provides everything that Open Banking Lab offers, plus a fully integrated developer portal to the FIs core system, allowing implementation of new services, integration of multiple external 3rd parties, monetization capabilities, and access to a Sandbox environment in UAT that allows accurate testing before going into production.

Connect what you need when you need it, ramping up functionality, customer experience, and time to market.

FinConecta is a global technology company that brings together digital solutions and businesses in the financial world and beyond. Our platform, 4wrd, accelerates digital transformation, innovation, and open banking, facilitating different use cases and new business opportunities.

Follow us in social media @finconecta

Contact us at contact@finconecta.com